- Email: help@creditrobin.com

- Phone: 1 888-231-8055

- Affiliates

12 Sep

Building credit can lead to despair if you do not know where to get started. Creditors come in all forms and some of them are out to take you for a road, so this alone makes the struggle increase. If you have bad credit or no credit then you know how difficult it is to get ahead.

Sometimes it may seem the more you try the harder it gets. In fact, this is sometimes true simply because too many people lack knowledge when it comes to building or repairing credit. Many people will take the wrong path when they are trying to build or repair their credit and this often leads to a bigger struggle.

If you are in search of a solution to repair or build, your credit the first thing you will need to do is get in contact with reality. The fact is if you have no credit or bad credit the world is on your shoulders and it will take you to get them rascals off your back.

Credit is essential nowadays and nearly every business asks for a major credit card. If you do not have, credit established or else your credit is bad then you are in trouble when they say, “all we accept are major credit cards.” The world has gone mad. Instead of giving you a job when your credit is bad to help you get back on your feet again, they will often turn you down.

This is insane, but it is the way the world operates. When you apply for a loan to get out of debt you will also get turned down in most cases. The lenders figure since you did not pay your first debts you probably will not pay your new debts. Lenders rarely take into consideration that your situation is temporarily and could change at any time.

When you do not have credit, few lenders do not assume that best possible option, rather they assume that you are a mishap in life. There are a few exceptions, but for the most part lenders look down on your when you have no credit at all or your credit is bad.

If your credit is bad, you might want to get started paying on your bills right away to repair your credit and get out of despair. If you do not have credit, it is time to start building for a better future as soon as possible. Instead of taking out a loan or else applying for a credit card on your own, you might want to take a trustworthy friend or family member.

Taking a friend or family member with you will come in handy when the lenders say, “do you have a co-signer.” After you are approved for a loan or credit card, make sure that you pay your bills on time to avoid defaults on your credit files as well as avoiding enemies. If you miss payments, the friend or family member that co-signed your contract is obligated to pay your dues.

This all sounds crazy if you think about. People everyday are filing bankruptcy, suffering debt issues, and so on, yet the system requires us to establish credit at an early age in life to stay up with the Smith and Jones. The system is set up to get you one-way or the other.

Therefore, if you are building credit for the first time makes sure that you do not overdo yourself. If you are purchasing a car, make sure you know what you are getting into to avoid future debt issues. If you are purchasing a car, consider a car that is inexpensive and economical to avoid overpaying for a fancy car that will only last for a short time. None of us really needs a Mercedes Benz, but some of us can afford it.

If you can afford a Mercedes and know that your future is prosperous by all means, apply for the loan. On the other hand, if you see that your future is shaky and you do not have the funds to support an outrageous lifestyle, then go for the Bug it is cheaper and it will save you despair in your future.

Related Post

We represent new beginnings and new hope for those in need of a better tomorrow with improved credit scores.

Legal Pages

© 2026 Credit Robin, Inc. All Rights Reserved. Product name, logo, brands, and other trademarks featured or referred to within Credit Robin, Inc. are the property of their respective trademark holders. This site may be compensated through third party advertisers.

Credit Robin, Inc. is committed to ensuring digital accessibility for people with disabilities. We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines.

Credit Robin, Inc. is a credit repair agency with credit repair training and counselors. Financial and legal advisors can be made available to assist consumers with credit issues. All users and customers must be in compliance with our Terms of Services and contracts made available online or in person.

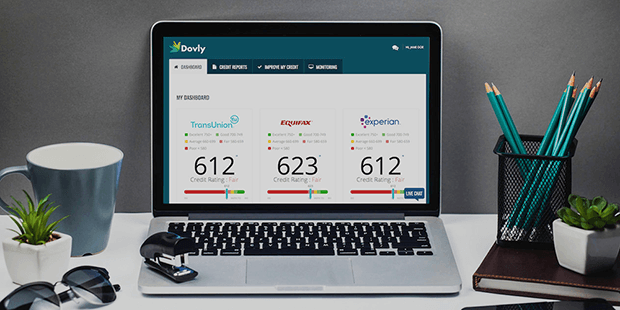

All logo and brands referencing iPhone, Android, Equifax, Experian, TransUnion and other organizational names are registered trademarks owned by each respective organization used under fair-use law.

Designed and Managed by Rank Above Others, Inc.